2020 started with construction continuing to roll after a successful 2019. In fact, we have seen about seven (7) years of growth in the construction industry and about ten (10) years of growth in the financial markets, though we did see a slow-down at the end of 2018 in the market that may have contributed to flatter growth in construction during last year.

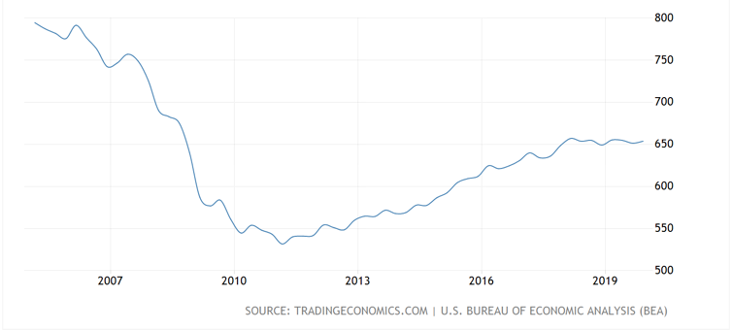

Below we see this reflected in the gross domestic product (GDP) from construction in the United States in billions of dollars. The line was flat from the second half of 2018 and into 2019.

By the beginning of 2020, analysts had already predicted it would be a slower year and we would experience some type of market correction after our long streak of growth. For BHB, the year started with much activity and some growth, both within the firm and in the industry around us. It was hard to believe that we were staring down the road of a recession. Looking back now, the signs were there, just blurred by the excitement of a new year.

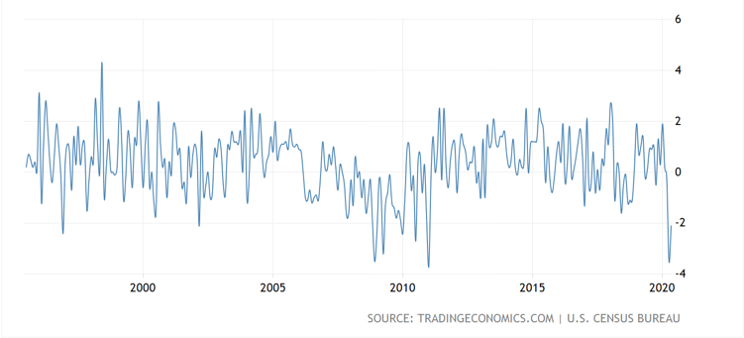

I don’t think anyone could have quite imagined what hit us in the second half of March. Nationally, construction spending quickly fell 3.5 percent (or $22 billion).

We have seen this deep drop before, near the end of the last recession, after several years of continuous decline. The impact of this pandemic was much faster, and some predict it may have a potential to rebound and recover just as quickly. According to local developers that we work with in D/FW, though, the economy cannot be controlled like a light switch. We can’t just turn it off, and then turn it back on and expect it to react. Investors and project leaders are expected to proceed cautiously as we emerge from the pandemic and recession.

Investors are facing much uncertainty as the entire world grapples with COVID-19. We saw entire market sectors halt with unprecedented unemployment. Hospitality, leisure, travel, oil & gas, retail, development, and even infrastructure improvement were impacted. The investment of capital seemed to stop or be pulled back until we could understand what was going to happen.

Market Impact

Investments and the U.S. stock market reacted quickly to the world events.

The Dow Jones Index gives us a reflection of the overall U.S. market performance, which was down about 11% at the end of May but showed a remarkable 24% gain compared to this year’s low near the middle of March. We also see in the graph that the tech industry (NASDAQ) also took a hit from the pandemic but has been the quickest to recover to show an actual growth since the beginning of the year. In the new world of telework and online collaboration, this makes sense.

Based on my experience, it seems that these quick impacts to the financial market have a longer impact on the construction industry. It will likely be twelve (12) months before we fully realize the depth of the impact of what we saw in the stock market. But, as Konstantine Bakintas (Principal and President at BHB) put it, we “should find comfort in the stock market bounce back, during the second quarter, to pre-COVID values. Most everyone is frustrated with the pandemic, yet an optimism about the economy is prevalent. The reopening of Texas has been aggressive, and has had to be slowed down, but has proven how much pent up energy and opportunity is out there.”

Impact to Construction

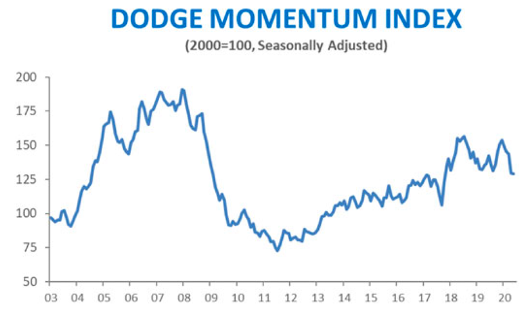

National construction starts are down 17% from the last peak in July 2018. Compare this to the 62% drop that we saw during the Great Recession. The quick onset of the pandemic was not like the gradual drop from the Great Recession and may have been the correction that economists were warning about in the market.

The Dodge Momentum Index below is a measure of the first report of nonresidential construction projects, which Dodge Data & Analytics reports to precede actual construction by as much as one year. The Great Recession is apparent in the graph with a steady drop over three years. The quicker decline due to the impact of COVID-19 at the beginning of 2020 can also be seen, but it also appears to be less dramatic and potentially trying to turn back up. Next month we may already start to see a recovery in the Dodge Momentum Index.

Where Do We Go From Here

The market has recovered right now to where we were during the 4th quarter of 2019. We expect there to be enthusiastic but cautious investment and monitoring by funding agencies to make sure we do not backslide.

Markets expected to recover quickest are infrastructure (roadways, rail, water, nationwide 5G networks), defense, healthcare, large warehouse, and technology (data center). The roughest road to recovery will be hospitality, travel, and retail.

Impacting our recovery will be the availability of workers. We started 2020 with a 50-year low in unemployment. It was described as a fully employed market at the end of 2019 and we were having challenges finding people with experience for the projected work in 2020.

Now we are facing the opposite problem – unemployment numbers that are anticipated to compete with numbers we haven’t seen since the Great Depression, 25%, according to Goldman Sachs. This could lead to a slower recovery due to lack of skilled labor in the trades, as well as the downstream service sectors.

Early national labor reporting in July hinted at recovery; the construction industry added 158,000 positions back last month. In total, the U.S. economy added back 4.8 million jobs in June, which equates to about one-third of those that were laid off at the beginning of the pandemic. Unfortunately, what gets swallowed in this number is that 7.5 million people lost their jobs in June. At this point in the pandemic, jobs lost may be harder to recover since they could be from businesses that are failing, which will have an impact on the recovery of unemployment rates for the rest of the year.

If we pull in the focus to Texas, we live in one of six states that Dodge Analytics has noted to have the highest level of construction activity, even in the face of the current recession. Personally, with 20 years of construction engineering in D/FW, I have felt this over the years. We have been blessed with different markets converging in one place. We have seen much growth in residential development, in infrastructure improvements, office construction, renovations, oil & gas development, schools, and retail.

The pandemic and accelerated recession has had a significant impact, though. For the months of April and May, BHB saw our typical new contract volume drop by over 40% compared to our average volume in these months. With businesses opening and some contracts being dusted off, the momentum within BHB last month jumped to 130% of a typical June. This was a promising change, especially because we saw civil infrastructure and development projects returning to typical levels. State-wide, construction activity through the end of May is up 4% compared to this time last year. According to Bakintas, public sector projects are progressing – both in design and construction. “Municipalities are reviewing Statements of Qualifications, and selecting consultants to help them construct, reconstruct and improve public facilities. In private commercial development, we experienced a hesitancy, but that has been replaced with an eagerness to move past the pandemic. Developers are pushing to move their projects forward, as quickly as the reviewing entities can accommodate them.”

We are expecting a third quarter that is by far better than the second quarter. Dodge Data & Analytics has predicted that construction will see a nearly 13% growth in Q3 and a 2% growth in the last quarter of 2020. Overall, this year is expected to finish with construction down by about 4%, according to Dodge’s predictions right now. This is very encouraging and is also expected to lead to better performance in 2021.

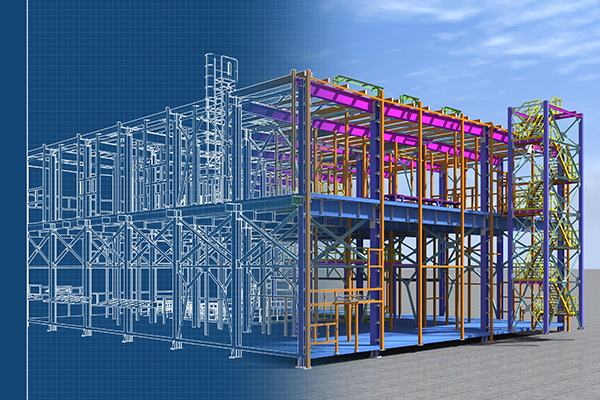

Half of BHB’s growth at the end of the second quarter has been in municipal projects, multi-family, industrial remodel, and new commercial construction. We have been helping our clients get ready to be back in business, to clean their air systems, and to upgrade facilities that may have been halted because of the pandemic.

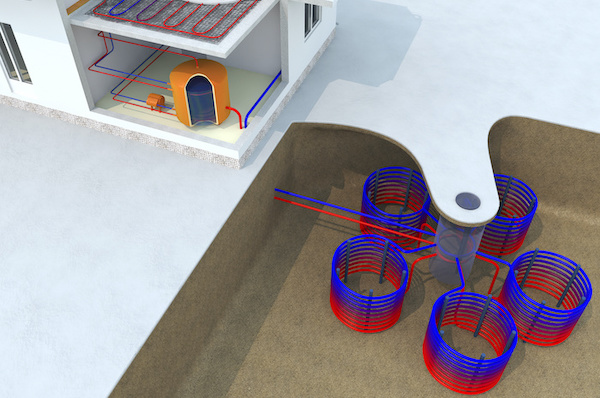

Our two largest projects that were awarded in June were both for Tarrant County Corrections to upgrade the central plant at a local facility. Our MEP team is designing the replacement of two 780-ton centrifugal chillers where staging and access will be critical. The facility cannot go offline, so the design and construction will need to consider one chiller at a time. The associated cooling towers are masonry towers that will also be rehabilitated with new PVC fill and variable speed fans. Inside the plant, the design includes replacement of the associated pumps and all controls to upgrade the plant from pneumatic operators to new digital controls. The impact of the project will be a new plant for the facility, but also a lower energy footprint for the plant, anticipated to be as much as 20% lower than it is today.

We also have a number of large private development projects in the works, such as a lakefront residential development in DFW. For this project, we are providing civil engineering and site development, land surveying, and landscape architecture.

The uniting event is that we are all in this pandemic together and will reach out a hand to help our neighbors. The construction industry is strong and resilient and adapts to changes. We will return from this recession with just as much enthusiasm as we did from the Great Recession and see more years of growth in front of us.